Overview

It may be necessary to set a state tax default rate if you are doing business in Texas or another state that requires taxes to be included. Sales tax is added during the creation of an invoice and is driven by the Loss Location State. FileTrac has added automation of the Sales Tax to limit errors in invoice creation.

The following is the recommended setting for optimal use of the sales tax system. You will need to set up the tax rate for the state in the Settings page, make sure each Service is set as Taxable, and make sure each Fee Schedule is set as taxable.

I. Setting State Taxes in Settings

You will want to be sure the tax is only applied to the states that are requiring it. To set up the state taxes, follow the instructions below:

1. Open the Settings page

2. In the Tax Rate section Check the box for Add New State

3. Click the drop-down arrow and select the State

3. Click the drop-down arrow and select the State

4. Enter the Amount of Tax to be applied in the Tax Rate

5. Click Add/Save Changes

Once the state is successfully added it will appear in the list with the corresponding tax rate that was saved. Continue with steps 6-8.

6. Enter zero in the Tax Rate field (This will keep all other states that have not been added with a tax rate of zero.)

6. Enter zero in the Tax Rate field (This will keep all other states that have not been added with a tax rate of zero.)

7. Check to Automatically Apply Tax Upon Invoice Creation

8. Click on Save Default Tax Rate

II. Setting State Tax for Service Fees

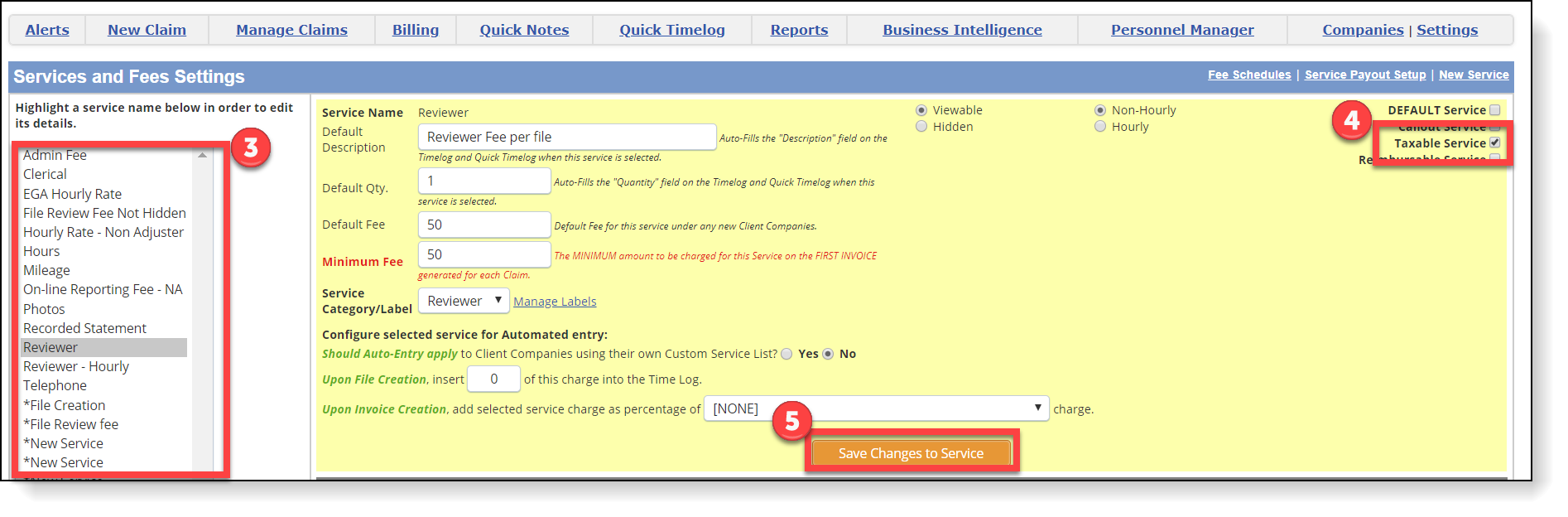

The final two steps are to make sure that your Services and Fee Schedules are set up as Taxable. You do not need to create all new services for the states that are taxable. When you toggle on to make the service taxable it will only apply to those states that have a tax rate created in Settings. Follow the instructions below to set up Services as Taxable:

1. Go to the Settings Page

2. Click on Services and Fees Click Here to Configure

3. Select a Service

3. Select a Service

4. Check Taxable Service

5. Click on Save Charges to Service

Repeat steps 3-5 for each service as needed.

III. Setting State Tax for Fee Schedules

The final step is to make sure the fee schedules will have tax applied. To do this you will need to open or create each fee schedule that will be used in the taxable state to verify it is toggled on. To do so follow the instructions below:

1.Go to the Settings Page

2. Click on Services and Fees Click Here to Configure

3. Hover over Fee Schedules and select the Fee Schedule that will be used in the taxable state

4. Toggle Taxable

5. Scroll to the bottom of the page and click on Save Schedule